inherited annuity tax calculator

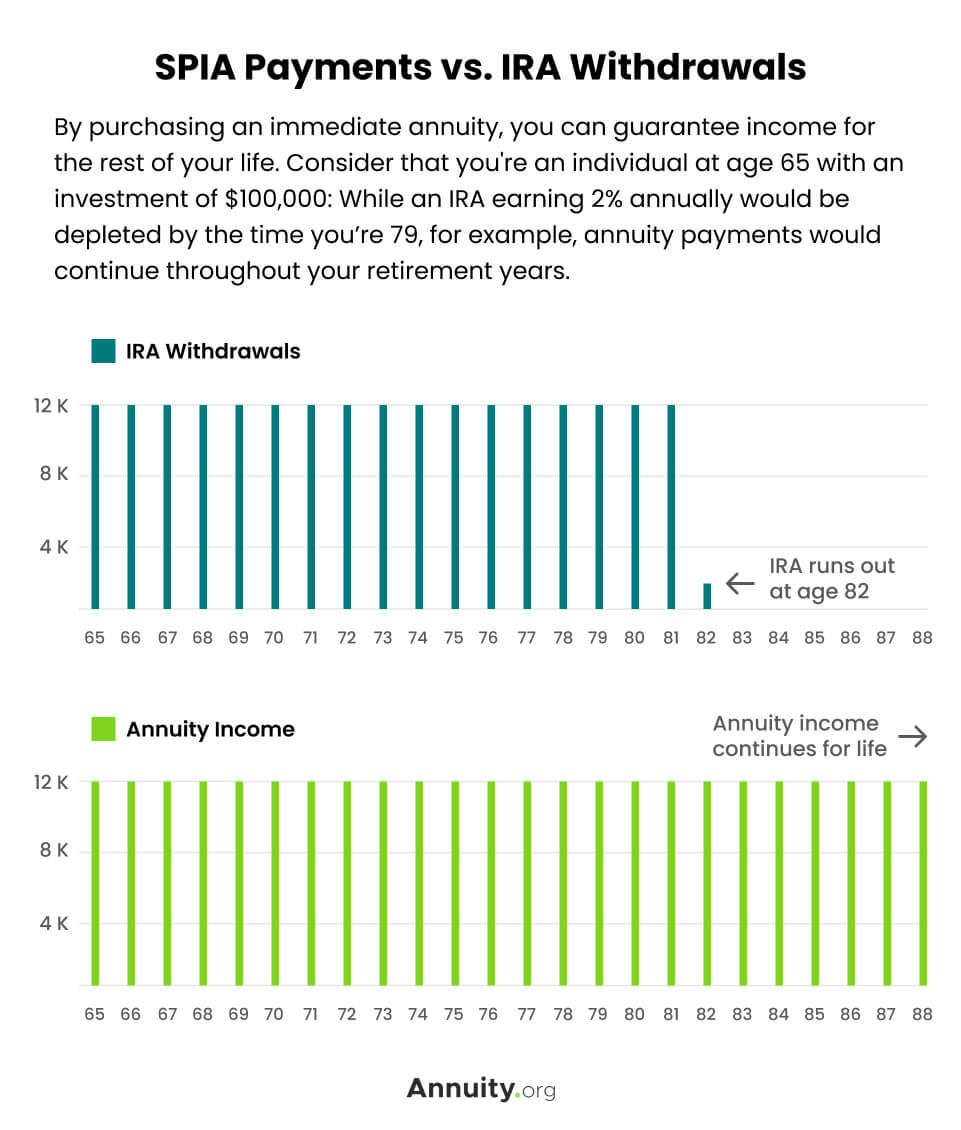

Inherited annuities come with a number of tax implications especially if the inherited beneficiary is a non-spouse. Two Traditional Annuity Inheritance Routes.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Different tax consequences exist for spouse versus non-spouse beneficiaries.

. For a non-spouse beneficiary a few different inherited non-qualified annuity options exist for payout which will determine how the money gets taxed. As a result inherited annuities are subject to tax. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities.

While an inherited annuity can provide an unexpected windfall the tax implications of withdrawing money from it could be costly. Annuities are taxed as ordinary income when inherited. For each I assume yes part of the distribution was an RMD.

Distribution penalty if she needed to take distributions from the inherited annuity before she reached age 59 12. Although you cant completely avoid taxes on annuity payouts by understanding how an annuity is structured and how you choose to receive the benefits you can minimize the tax burden while taking greater advantage. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed.

See how to calculate. If the beneficiary is a spouse of the deceased annuitant they can carry on with the original annuity contract without any immediate tax implications. The proceeds of an inheritance are taxable.

The earnings are taxable over the life of the payments. I inherited 3 annuities from my father who died in 2014. Qualified annuities are funded with pre-tax dollars while non-qualified annuities are funded with after-tax dollars.

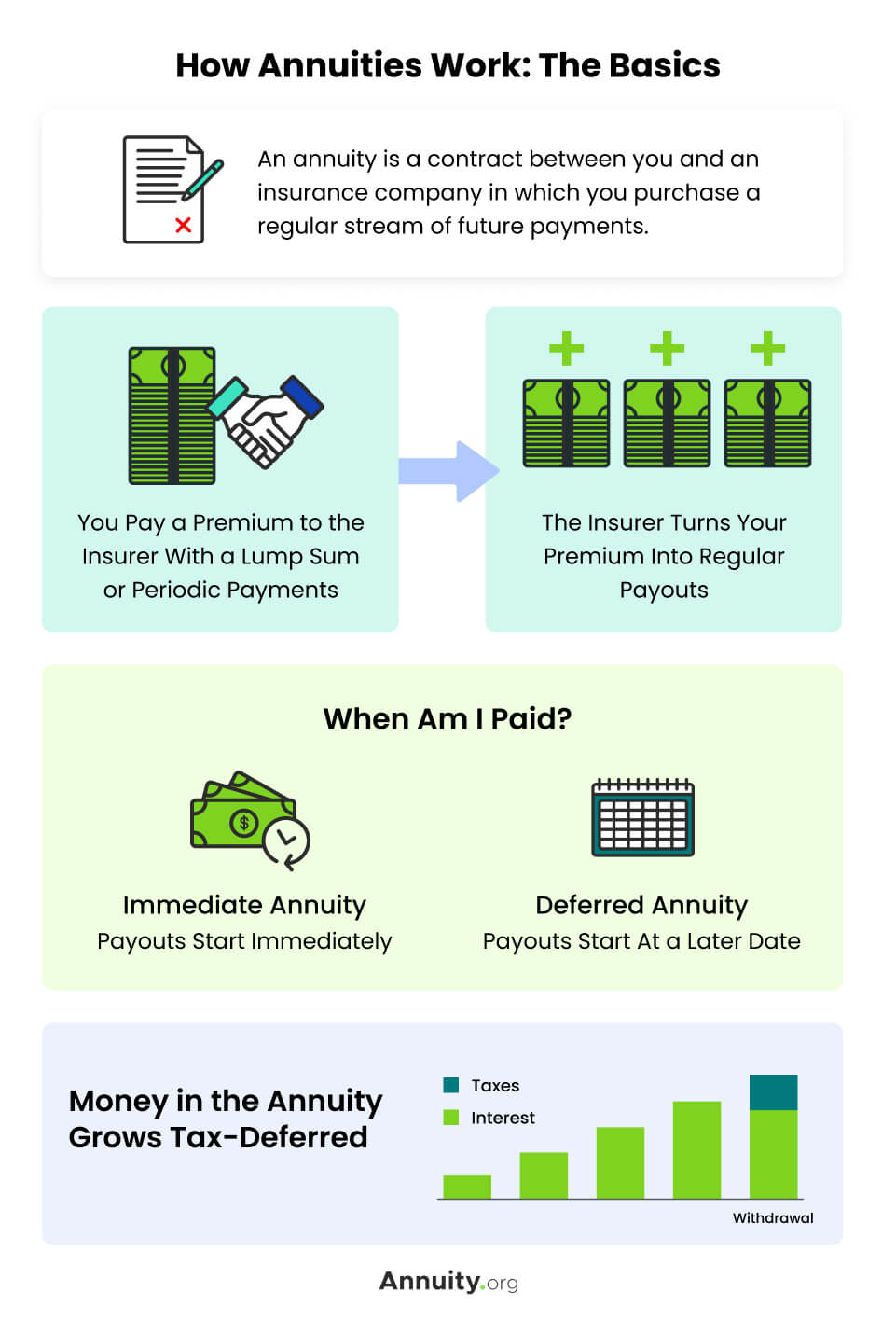

The taxes you may owe are dependent upon the distribution option you choose. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account balance.

Tax-deferred annuity beneficiaries can pick from a variety of payment alternatives that will affect how the income benefit is taxed. Inherited annuity tax calculator Saturday March 26 2022 Edit. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to.

Tax rules tax implications tax liability and if you need to pay taxes on the inherited annuity will all come into play. Depending on the type of annuity the tax will have to be paid on the lump sum received or on the regular fixed payments. A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account.

Estate taxes may come into play as well. By The Money Farm Team. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would.

This is only if you take a lump sum. The income from an inherited annuity is taxed. How taxes are paid on an inherited annuity will depend on the payout structure selected and the.

I inherited 3 annuities from my father who died in 2014. By The Money Farm Team. Surviving spouses can change the original contract into their own name.

The spouse of the annuitant can convert the contract into his or her own name if the beneficiary is the spouse of the annuitant. However if the beneficiary is a non-spouse the taxes depend on the payout. Depending on the payout option selected the beneficiary of a tax-deferred annuity will be taxed differently on the income received.

If a beneficiary takes the money over time no taxes are owed until the annuity is cashed in. Inherited annuities come with a number of tax implications especially if the inherited beneficiary is a non-spouse. The difference stems from the way the two types of annuities are funded.

Tax Rules You Should Know. Once the annuity enters the annuitization phase they must begin paying taxes on earnings as well as any other untaxed portions. It is possible for the annuitants spouse to take over the contract in his or her own name if the beneficiary is the spouse.

Annuity Taxation How Various Annuities Are Taxed. If you were born before Jan. In turn taxation of.

Annuities are also included in the estate for federal estate tax calculations. If a beneficiary opts to receive the money all at once he or she must pay taxes immediately. Inheriting a qualified annuity on the other hand means owing taxes on any withdrawals from the annuity including principal and interest.

If a non-qualified annuity is annuitized then a portion of the payment is a return of the contributions which is also tax-free. Inheritance Tax guaranteed annuity calculator Use this calculator to help you work out an estimated market value of guaranteed annuity payments when valuing assets of the deceaseds estate. Principal that was not taxed and earnings will be subject to taxation as income.

How do I calculate this. Less common qualified retirement plans include defined benefit pension plans 403bs similar to 401ks Keogh Plans Thrift Savings Plans TSPs and Simplified Employee Pensions SEPs. A surviving spouse can usually just keep the annuity intact and continue to defer taxes.

Because your wife chose to cash in the annuity a portion of what she received will be income. So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability. TurboTax is asking what part of the distribution was an RMD.

Tax Consequences of Inherited Annuities. TurboTax is asking if the withdrawals were RMDs. If the beneficiary decides to take all of the annuity money in a lump sum payment shell.

This allows partners to enjoy the same. In the US a tax-qualified annuity is one used for qualified tax-advantaged retirement plans such as an IRA or 401k.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Annuity Taxation How Various Annuities Are Taxed

How Annuities Work Examples By Type Considerations

Are You Looking Forward To Your Golden Years Proper Planning Could Help Ensure That You Ll Have Enough Funds To College Finance Retirement Financial Education

Annuity Formula Calculation Examples With Excel Template

Annuity Taxation How Various Annuities Are Taxed

This Valuable Retirement Savings Hack Just Disappeared Forever The Motley Fool Saving For Retirement The Motley Fool Retirement Accounts

Annuity Beneficiaries Inheriting An Annuity After Death

Taxation On Annuities Annuity Tax Information Lifeannuities Com

Annuity Beneficiaries Inheriting An Annuity After Death

Taxation Of Annuities Ameriprise Financial

Pin On Low Carb High Protein Recipes

Use Inheritance To Pay Off Credit Card Debt Not Mortgage Paying Down Credit Cards Ideas Of Paying Down Cr Paying Off Credit Cards Dollar Annuity Retirement

The Lack Of Financial Literacy Leads To More Problems Down The Line For Things Like Applying For A Credit Card Financial Literacy Finance Financial Advice

Fidelity Guaranty Life Safe Income Plus Annuity Review Annuity Income Saving For Retirement

The Best Annuity Calculator 17 Retirement Planning Tools

Annuity Payout Options Immediate Vs Deferred Annuities