massachusetts real estate tax rates

Current Property Tax Rates. An owners property tax is based on the assessment which is the full and fair cash value of the.

Real Estate Archives Page 2 Of 6 North Of Boston Lifestyle Guide

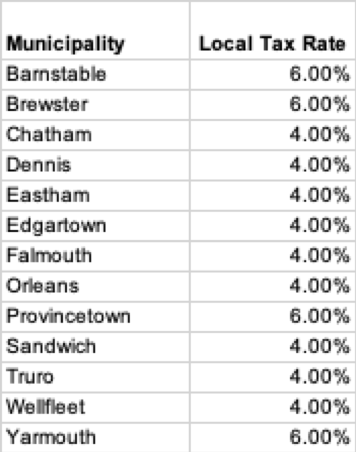

A local option for cities or towns.

. A state excise tax. Massachusetts Property Tax Rates. Generally Massachusetts is a high tax state and the average homeowner pays 114 of their home value.

They are expressed in dollars per 1000 of assessed value often referred to as mill. The median property tax in Berkshire County Massachusetts is 2386 per year for a home worth the median value of 207800. If the total tax on real estate is over 3000 the tax must be paid by the date due in order to maintain the right to appeal an abatement decision.

The towns in Worcester County MA with the highest 2022 property tax rates are Bolton 1987 Lancaster 1945 and Sturbridge 1915. Tax amount varies by county. Berkshire County collects on average 115 of a propertys.

The three Worcester County towns with. Tax rates in Massachusetts are determined by cities and towns. Today the Massachusetts real property tax rate depends on the city or town as well as classification.

You can look up your recent. Massachusetts has a 625 percent state sales tax rate and. The median property tax in Massachusetts is 351100 per year based on a median home value of 33850000 and a median effective property tax rate of 104.

They are expressed in dollars per 1000 of assessed value often referred to as mill. Click here for a map with additional tax rate information. Here you will find the 2015 final tax rates for.

Looking for expected 2016 Tax Rates. 370 rows Massachusetts Property Tax Rates by Town. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

Real Estate Tax Rates for Massachusetts Towns Hello. A state sales tax. Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate.

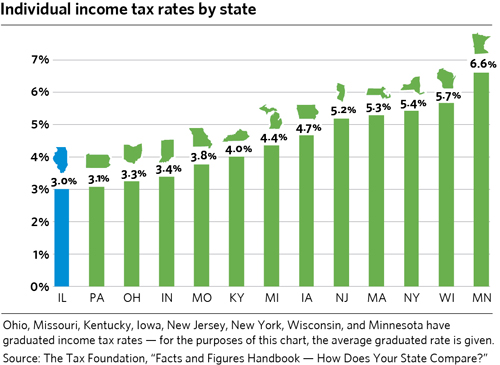

Chilmark has the lowest property tax rate in Massachusetts with a tax rate of 282 while Longmeadow has the highest property tax rate in Massachusetts with a tax rate of 2464. Property tax is an assessment on the ownership of real and personal property. Massachusetts has an 800 percent corporate income tax rate.

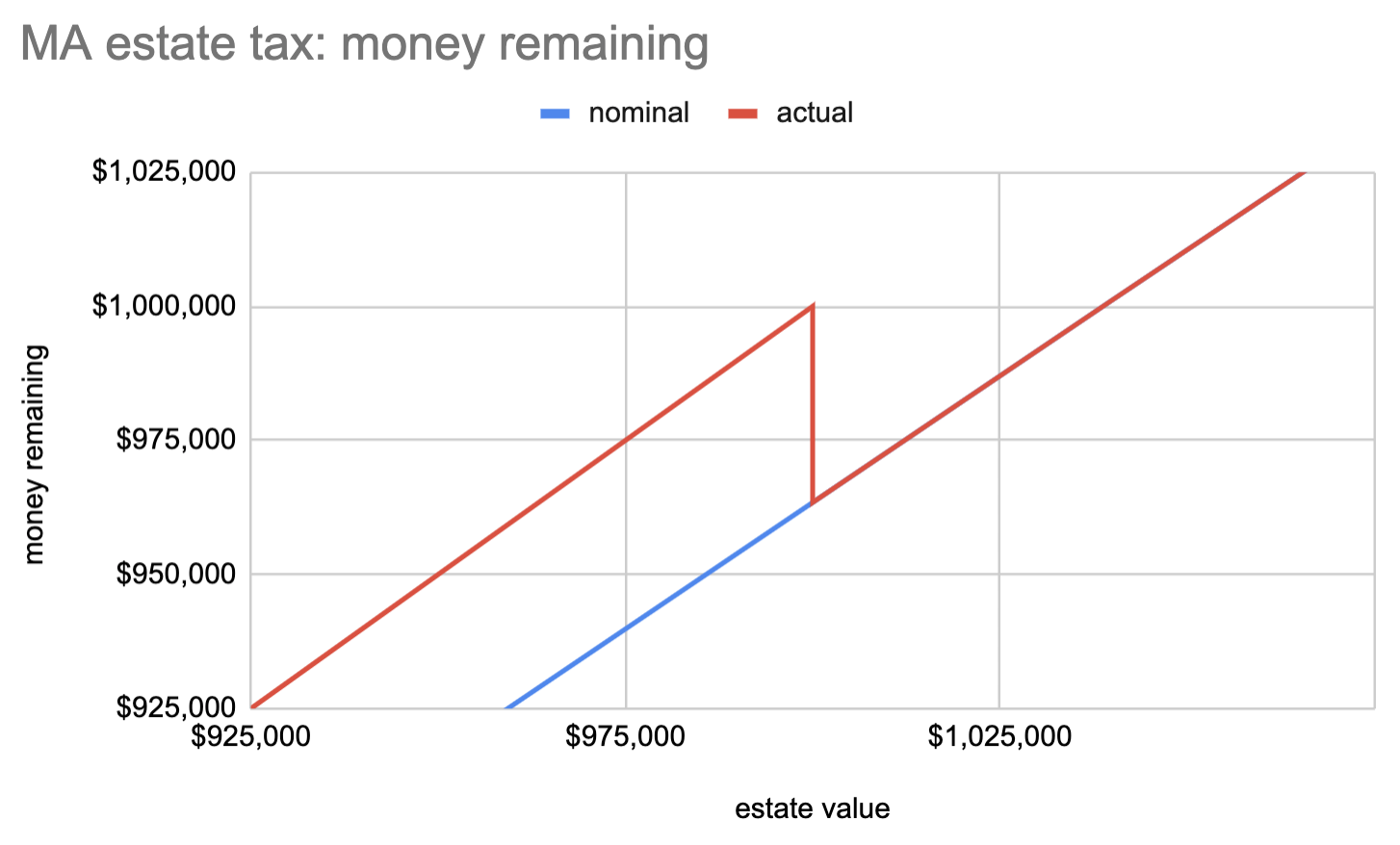

Massachusetts Estate Tax Rates. Dont worry - I have them for you here. But the total tax levy for the city or town remains the same.

Tax rates in Massachusetts are determined by cities and towns. Of that 167 billion or 216 of the total revenue collected is from property taxes. Massachusetts has a flat 500 percent individual income tax rate.

351 rows 2022 Massachusetts Property Tax Rates. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. Massachusetts Property Tax Rates.

Under Massachusetts law the government of your city public schools and thousands of other special purpose districts are given authority to evaluate real estate market value set tax rates. Rate Threshold 0 40000. Counties in Massachusetts collect an average.

Massachusetts Property Tax H R Block

Massachusetts Property Tax Rates In 2018 By Town And City Boston Business Journal Property Tax Massachusetts Business Journal

How Do State And Local Property Taxes Work Tax Policy Center

2022 Massachusetts Property Tax Rates Ma Town Property Taxes

2020 Residential Property Tax Rates For 344 Ma Communities Boston Ma Patch

Cape Cod Lodging Tax Vacation Rental Tax Short Term

Massachusetts Property Tax Rates In 2018 By Town And City Boston Business Journal

Property Tax Rates In Midland Nc

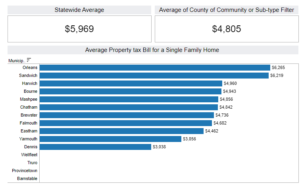

Barnstable County What Towns Tax The Most Housing Latest News

Dusting Off The Income Property Tax Swap Debate Cmap

Golocalworcester Ma Has 8th Highest Auto Taxes In U S

Montgomery County Leads The Pack See Which Ohio Counties Have The Highest Average Residential Property Tax Rates Cleveland Com

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

What You Need To Know About Property Taxes In Massachusetts Buying News Boston Com Real Estate

Real Estate 101 Understanding Property Taxes Jack Conway Realtor

States With The Highest Lowest Tax Rates

Property Assessment Valuation Guidance Mass Gov

2022 Residential Commercial Property Tax Rates Ma Cities Towns Across Massachusetts Ma Patch